Delivering robust and actionable cost and profitability management with Anaplan

Every company does cost and profitability management in some shape or form, the most frequent being month-end ‘allocations’ where indirect sales and operational costs and other overheads are apportioned down to lines of business, and occasionally products and customers, using some easily accessible metric such as revenue or headcount. The trouble is that ‘peanut-buttering’ costs around in such a manner is never accurate in that products and customers that consume a high level of resources end up with less cost than they deserve and those that consume a low level of resources are over-costed. Neither can apportionment deliver actionable, bottom-line insights that help colleagues with commercial responsibilities with their tactical day-to-day decisions and strategic planning, as it fails to show them which levers to pull on to reduce costs and improve their profitability.

Most often such apportionments are carried out as a sub-routine within a planning app or more typically as an off-line routine using spreadsheets. Occasionally companies will have implemented a siloed cost and profitability tool that often proved so complex to refresh or keep in step with the business that it was rarely if ever, used.

Such obsolete paradigms and outdated technologies need to be replaced with a robust but nimble cost and profitability management framework. This framework needs to provide accurate results and better transparency into true bottom-line performance, as well as actionable insights into the business levers that can be adjusted to impact future profitability results.

It also means delivering cost and profitability reporting that satisfies both the needs of those responsible for backwards-looking enterprise reporting, and forward-looking insight for a diverse community of end-users responsible for pricing, margin analysis, customer segmentation, and more.

Read on to find out how our experienced team at Profit& can help you make your cost and profitability management fit for purpose.

01 Why having accurate and accessible cost and profitability is imperative

In the current commercial environment, both tactical decisions and longer-term business strategies need to be quickly taken, well-informed, and preferably right first time. But unless the business has accurate and reliable information immediately available about the true cost and profitability of its products, channels, and customers, such decisions are made ‘blind’ following what is all too often a “fact-free discussion”.

That’s no way to manage a business. Business leaders need to know which customers, products, and channels contribute to profit, which incur losses, and how to improve the situation, always recognising that there are always going to be some parts of the business, such as marquee customers and low turnover products offered to provide customers with a one-stop-shop, that will never be profitable. Given the complexity of business today, it’s not always obvious where to look to make the incremental commercial and operational changes that improve profitability. But there is one thing for sure; finance professionals will never add value unless they deliver the timely and easily accessible insights that enable their commercial colleagues to do it.

Timely, relevant, and actionable cost and profitability needs a robust foundation

All good structures need a robust foundation and cost and profitability reporting is no different. To add value, build models in which costs are assigned to products, customers and channels based on the scientific, cause and effect relationship that actually reflects real life.

With the exception of business-sustaining costs such as corporate image marketing and annual audit, most costs have a transactional cause with an associated quantifiable driver. For instance, the cost of a claim processing department in an insurance business is driven by the number of claims and can be assigned reliably to those policyholders that claim - albeit perhaps with some weighting to reflect the reality that certain types of claims are more complex and take longer to process. Some costs, such as sales promotions for a particular product or customer can be directly assigned, whilst others, such as advertising costs, the driver could be taken as either the net revenue or the incremental net revenue by product, customer, and channel. Just because it is not obvious which driver to use in such instances, doesn’t make it wrong. It is always far better to make an estimate using the most appropriate driver that underpins the cause of the costs, than use the wrong one which just muddies the waters.

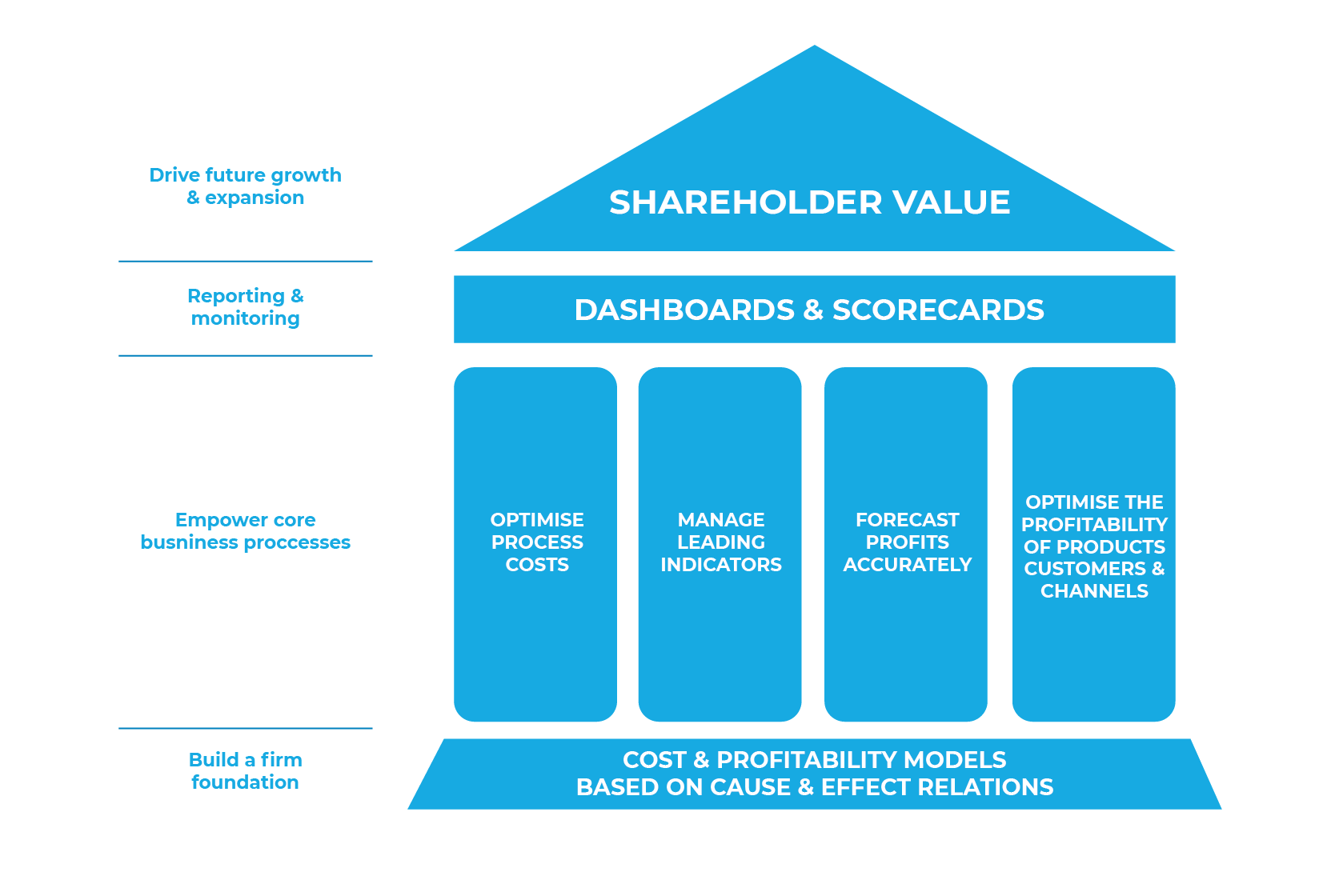

The imperative is to minimise the amount of ‘peanut buttering’ and build models where as much of the costs as possible are assigned based on their actual cause and effect relationship, because until you understand how profit is “caused” you cannot set about making more. Once this is done, there are solid foundations in place for building the pillars of accurate and actionable cost and profitability reporting as represented in the diagram below:

Pillar 1: Optimise process costs

Although most businesses can list their core processes, few measure their costs and even less identify laborious and time-consuming activities, such as processing customer returns and issuing refunds. Such activities add no value, so routinely monitoring them and creating projects to eliminate, minimise or streamline them, typically results in a step-change in the amount of resource consumed, and cost savings that directly impact the bottom line.

Pillar 2: Report and manage “lead” indicators

Rather than measuring and reporting on a gamut of key performance indicators, (KPI’s), such as customer satisfaction, that only have an implied relationship with financial results, using cause and effect relationships to model costs and profitability gives a set of indicators that can be the basis of a focused and action-orientated set of KPI’s.

For instance, the process “fulfil customer demand” consists of activities such as input order, pick, pack, load, deliver, etc. Each activity has a volume that may be used as a driver to allocate costs to product/customer/channel, a resource consumption rate that measures the productivity of resources involved, and ultimately a calculated cost per unit of driver. This level of complexity may not be necessary, however. There may be no point in managing “lag” indicators as by definition they are not the cause. Typically the volume that drives the process is the number of sales orders and order lines (SO/SOL) and this is the “lead” indicator. SO/SOL start the process running and whilst individual activities may have different drivers, in most businesses they are broadly proportionate to #SO/SOL, so the whole process can be allocated to product/customer/channel using the lead driver, #SO/SOL. Doing this brings considerable benefits. Allocations are easier for less technical users to comprehend, there is far less data to collect and collate, reducing the time and costs involved in maintaining the model, and the KPI of Process cost/SOL is easy to calculate and interpret across multiple forecast/scenario versions.

Using this principle allows the business to be managed using the “lead” indicators, (in this case the volume of sales orders and the total cost per order), that can be drilled into to identify the causes of trends and variances that need management action. Adopting such an approach to selecting performance indicators ensures only those that really help the business to improve profits are included in dashboards and scorecards.

Pillar 3: Forecast profitability

Businesses that can explore the various scenarios that the future may hold, and are able to make well-informed and incisive decisions quicker than their peers, are typically the most successful. So having a robust cost model built on cause-and-effect relationships is a distinct advantage, as it can also be used to predict future profitability, together with insight into what actions are crucial to its delivery.

For example, running an airline is a notoriously complex business with lots of input volumes to forecast and juggle, such as passenger numbers, flights, aircraft types, meals, and kilometers flown. But any airline that already calculates the unit costs of its core business processes (ticketing, check-in, despatch, baggage handling, etc.) using cause and effect relationships, can simply input anticipated volumes into the same model, extrapolate unit costs based on their knowledge of any expected changes in input costs, and it has a model for scenario planning and forecasting future profitability. Using the model, they can make tactical decisions about the best type of aircraft to use on each route or round trip. The most agile operators make operational decisions to add capacity or modify their schedule by adding, cancelling, or merging flights at relatively short notice, based on their predicted profitability. The same model provides the basis for longer-term scenario planning, by helping to provide insight into strategic decisions about which types of aircraft to acquire or decommission, and how best to develop their network and schedule.

Pillar 4: Optimise the profitability of products, customers, and channels

Most companies measure the gross margin of their customers, products, and channels, but very few understand their true bottom-line profitability. This practice has prevailed for decades, mainly because the enterprise resource planning (ERP) systems used for managing the business only support the direct apportionment of costs to products and customers, and not the more complex cause and effect assignments that would require complex coding. This is virtually impossible in a system designed for transaction processing.

Managing a business using gross margin, or worse still gross revenue can result in behaviours that destroy rather than create profits, such as focusing sales efforts on customers with high gross margins. Typically once the indirect costs that appear below the gross margin are allocated to customers and products using the cause and effect relationship, (such as allocating sales force costs according to how much time is spent with each account), transforms the business’s view of where profit is really created and provides the detailed insight needed for driving improvements.

It sounds simple, doesn’t it? It’s just attributing all the costs that a product, customer, or channel creates using a bit more science to provide an analysis of ‘true’ profitability. Even in the 21st century many companies still lack this fundamental building block. One could be forgiven for being amazed companies don’t already have this management information.

Putting on the roof!

Topping the four pillars of our schematic with dashboards and scorecards for reporting and monitoring enables the business to drive shareholder value by improving the profitability of its current business, and exploring scenarios about what the future may hold. Build the structure and transform your enterprise performance capabilities. But note, the structure needs to be built from the bottom up, starting from the solid foundation of costing methodology based on cause and effect relationships, otherwise it’s an edifice built on sand.

But how do I get there?

02 6 Fundamentals of a successful cost and profitability management implementation

To be of value, cost and profitability reporting needs to serve the needs of a diverse set of end-users across the business, helping them make better commercial and operational decisions about pricing, customer segmentation and process improvement. It should also meet the needs of those responsible for internal and external reporting, with drill-downs into business segments, regions, products and clients.

That means it needs to be quicker, more frequent, and more action-orientated than in the past, without becoming an overly complex implementation that the finance department struggles to maintain. Here are what we at Profit& think are 6 issues that make for a successful cost and profitability management implementation:

1. Start with a project plan

To deliver a cost and profitability framework on time and to budget means managing your project from start to finish, establishing the important project milestones that must be met, identifying and sequencing the tasks involved, and adequately provisioning the resource required to meet the critical deadlines. Implementing a cost and profitability framework may be new to you, but our team at Profit& has deep knowledge and extensive experience that spans several decades and a variety of industry sectors. After an exploratory meeting to get to know your business, we can bring our knowledge of technology, best practice methodology, and project management to help you develop a project plan that will facilitate smooth implementation.

2. Don’t over-complicate it

Although the cost and technical capability of adding granularity have dropped significantly in recent times, avoid creating data just for the sake of it. Working with end-users to better understand whether adding complexity really helps them make better decisions or whether it’s just a nice to have, always remembering that today’s modelling tools are flexible enough to retrofit such requirements at a later date.

3. Use data transparency to build trust

Use the ability to trace costs from product and customer profitability statements back to the general ledger to help build trust with users, because if they don’t believe the numbers you can be sure they won’t use them in their decision making.

4. Refresh the model frequently

Outputting cost and profitability reports infrequently does nothing to drive their adoption. Ultimately, the goal should be to make cost and profitability reports available to business leaders early in the month, using dashboards that clearly show both trends and exceptions. So, automate data integration and calculation routines wherever possible, and ensure there is sufficient resource within the finance function to both maintain and enhance the implementation.

5. Insist on self-service delivery

Aim to provide self-service insights on demand. Give finance and business users access to curated and certified data sets to allow for analysis on demand and generate customised self-service insights. Additionally, finance professionals responsible for maintaining and enhancing the solution – and even authorised business users themselves – should be able to maintain and amend a model using simple syntax and drag-and-drop functionality to express even the most complex multi-dimensional dependencies, without relying on ‘power users’ from IT or outside resource. Once written, the assignments at the heart of cause-and-effect cost models should not be buried deep inside a model that can rapidly become a ‘black-box’, but easily accessible and easy to amend by a trained finance professional.

6. Invest in training and adoption

Ensure that both those in the finance function and other users across the business have sufficient training to understand their cost and profitability reports, and how they can use the insights they provide in their decision-making. At the same time embed profitability insights within your key finance processes and workflows, so they are used to support day-to-day decision making, rather than consulted only sporadically.

Integrating historic cost & profitability reporting and scenario analysis

A further fundamental of cost and profitability management implementations today is that they must unify the backward-facing perspective of analysing past performance, with the forward-facing perspective of modeling the cost and profitability of likely business scenarios. In the past, the routine and timely delivery of historic reports was frequently a challenge, and integrating the two perspectives using legacy applications, disparate processes, and patched together data management, was virtually impossible. However, such integration is imperative. Business leaders in all sectors must react more quickly and decisively than ever and in the current environment, making strategic decisions has become almost a weekly occurrence for many. But with outdated cost and profitability management as a foundation, actuals that are lagging, and unreliable forecasts, finance teams struggle to provide meaningful profitability insights and identify appropriate actions for business leaders.

What finance professionals need today is a more agile platform, that can both calculate accurate and reliable cost and profitability reports and deliver instantaneous ‘what-if’ scenario analysis based on the latest actuals. That way, businesses can quickly model the bottom-line impact of major disruptions, such as losing a major account, or a significant change in forecast business volumes. What’s more, the finance professionals responsible for constructing such scenarios must be able to do it themselves, without opening an IT service ticket, or relying on continual outside support.

Inevitably, delivering such integration means abandoning legacy tools, such as standalone costing solutions and spreadsheets, and embracing transformative modelling platforms such as that offered by our partner Anaplan.

03 Why choose Anaplan for cost and profitability management?

The Anaplan platform was designed and built to facilitate the rapid building of the type of often complex, multi-dimensional models encountered in cost and profitability management, enabling you to improve the accuracy of your allocations without any extra effort. You can:

Move from simple apportionment to cause-and-effect allocations

Anaplan’s ease of data integration enables you to build allocation rules using any data from other applications in Anaplan or by loading data from transactional systems. That way you can select the driver that best reflects how a subsidiary, product group or customer segment consumes each item of expense - making results far more accurate than simple apportionment.

Improve the detail and accuracy of your profitability reporting

Anaplan’s ability to process masses of data without any performance deterioration makes it possible to build cost allocations down to individual stock keeping unit or customer level, where required. Results are not just more accurate but provide more actionable insight into variances. Regardless of how detailed your allocations become, you will never have to wait for results and queries to be processed.

Benefit from real-time modelling

Unlike traditional allocation tools or spreadsheets that struggle with large volumes of multidimensional data, Anaplan’s patented HyperblockTM technology delivers optimal performance no matter the data volume and your application’s model complexity. Update or change models of any size, from one to one trillion cells, instantaneously online. Whether your question is big or small, Anaplan’s engine responds immediately.

Collaborate on a single source of reliable and highly transparent data

Anaplan delivers a central repository—The Anaplan Hub—to reconcile various sources of data for clean, reliable hierarchies and master data (products, employees, cost centres, etc.) accessible to analysts around the enterprise. That way you have total confidence in the accuracy of your data, reports, forecasts and plans. This is particularly important where users of profit and loss reports will want to traceback the amount and origin of costs that have been assigned to particular products and customers and often the business logic of the cause and effect relationship used to make that assignment. With Anaplan, it’s easy, removing any debate about the validity of the figures and focusing the discussion on what they mean and what actions to take.

Build and maintain models with minimal outside help

Anaplan’s flexible hierarchy management and intuitive rules mean you can easily configure and manage changes to the way you want to make allocations without having to call on outside assistance. There’s no complicated scripting language required to build a model—just simple formulas expressing dependencies. With the platform’s open data model, you can simply construct whatever combination of dimensions you need. Key to this flexibility is Anaplan’s Living BlueprintTM—a single, easy-to-manage store of all the logic, calculations, and settings in your application. And using our built-in intelligence, it is easy to roll up results to deliver profitability reporting across different dimensions and alternate hierarchies.

Shorten the time to value

With Anaplan’s cloud-based delivery, there’s no waiting for hardware or software installations and no software version numbers, upgrade hassles, and IT queues. Providing the highest levels of availability, reliability, and security, Anaplan is a unique blend of patented technology that securely collects and stores data.

Build a foundation for a myriad of other use-cases

By the time you have built your cost and profitability framework with Anaplan, you will have a firm foundation and accumulated knowledge and experience to expand its use into other use cases. You can do this because Anaplan is a highly flexible cloud-based planning and modeling platform that enables organisations to automate planning, integrate data, and drive dynamic real-time updates to a myriad of different types of financial and non-financial processes, across finance, sales, marketing, workforce (HR) and the supply chain. This is despite the fact that they may frequently be working on differing time horizons and at vastly different levels of granularity. Connected planning, as our colleagues at Anaplan label their unique offering, brings together all of these previously separate processes, so users from across the business can collaborate around real-time models that share a single data set, with enterprise levels of access rights and security.

You choose the Anaplan platform to transform your cost and profitability reporting, but the flexibility of the Anaplan platform means you can incrementally implement Connected Planning by growing your deployment across your business to address your next pressing need. It could mean addressing revenue planning before integrating various aspects of sales planning. Alternatively, it could be that the most pressing needs are entirely within the finance function and that might mean connecting revenue and expense planning with profit and loss statement forecasting, and then balance sheet and cash flow and capital expenditure forecasting before growing the deployment out into other business functions.

04 Real-life examples of transforming cost and profitability reporting with Anaplan

Orkla Foods Norge

Profit& helped Orkla Foods Norge, a leading supplier of food and beverage in Norway, replace an outdated cost and profitability solution that was hard to maintain, took a long time to run and provided insufficient detail, with a new cost and profitability framework built on the Anaplan platform. Cost allocation methodology has been improved to give greater accuracy and transparency of results, as well as faster calculation times. It is now better integrated with data sources to improve the reliability of results, and model maintenance has been dramatically reduced with the Finance team reducing the time spent on model maintenance by approximately 50%.

Orkla can now reliably monitor and track the profitability of its products by customer and channel. Users are confident that results are accurate and information is delivered when they need it. Business regained control of the cost base thanks to improved cost driver data. In addition, scenario modelling is used to see the impact of key changes. This capability supports business planning and assessment of strategic options.

UK General Insurer

Our team helped a multinational insurance company headquartered in London to streamline and improve the costing and cross-charging of IT services. This had previously involved considerable manual intervention, downloading data from multiple systems to IT Services models in MS Excel. This spreadsheet model was prone to error, provided little or no transparency or actionable insight for internal customers, and was reliant on just a few key staff.

Building a new IT services cost model in Anaplan enabled transparent, accurate cost allocation using the drivers of cost that end-users understand. Anaplan is now distributed to business users who have complete insight into how their charges are made up and can monitor their consumption and adjust their requirements during the year.

05 How to choose an Anaplan partner that's right for you

Choosing the right Anaplan partner to ensure best practice is followed and full potential value is achieved is a job in itself. An accredited Anaplan Partner will bring experience to your project and help your team to get the most out of your implementation. So what exactly should you look for in your search for an experienced Anaplan partner?

Make sure they are an Accredited Partner

Perhaps the most obvious factor to research in a potential partner is their level of experience. If a company is run by experienced consultants, there is a higher likelihood of success than with one run by relative novices. Members of our team at Profit& have been delivering both cost and profitability solutions and planning solutions for decades, giving us cumulative experience across hundreds of projects spanning a variety of business sectors. Such a wealth of knowledge helps us continually refine best practices and makes certain that even our newer team members can share our tried and tested ways of working.

All of Anaplan’s accredited Silver, Gold or Global partners have demonstrated they are well resourced, have a history of successful implementations, and have managed intricate implementations. Profit& is an Anaplan Silver Partner, meaning we’ve delivered consistent, top-quality work, albeit not on a global scale nor across the entire gamut of industries. We have a more selective client base, meaning we can devote more time and focus to your business, developing a deeper understanding of your specific needs and the challenges you are likely to face in the future.

Check they understand your business

The best Anaplan partners will provide a detailed answer when asked how to solve the issues your organisation faces. This answer should cover how they intend to use Anaplan, how it fits your situation, and what kind of solutions will be created. These kinds of answers are reinforced by the level of customer service you’re given. The right Anaplan Partner will have a team of dedicated specialists ready to help you on your way to connected planning. At Profit&, we’ve helped companies across our territory deliver successful multilingual implementations of the Anaplan platform, with particular expertise in delivering successful cost and profitability management solutions across a variety of different sectors.

Read their client testimonials

The right Anaplan Partners need compelling testimonials. When searching for a partner, look into what their clients are saying. This will give you a good, external view of the partner and what they’re like to work with. You can explore some of Profit&’s client case studies, such as our work with a UK General Insurer, Grifols and Orkla Foods Norge. These are all successful examples of how Anaplan can improve your business processes.

06 How Profit& Can Expedite Your Cost and Profitability Transformation

Here at Profit&, we use Anaplan to implement both cost and profitability solutions, and planning solutions, across your business. We analyse the structure of your business, your day-to-day business methodology and create bespoke solutions to begin using in Anaplan. This includes creating a desirable business case to support the creation of industry buy-in.

We start with your needs

When it comes to FP&A process transformation, typically the pressing need is to replace a legacy costing or planning system and automate laborious processes to expedite cycle times and improve productivity. Sure, we will do all that for you. However, we promise we won’t leave you with a ‘vanilla’ solution. Our deep knowledge of the Anaplan platform and our insight into other customers’ successes mean we will endeavour to deliver an innovative solution that provides you with the capabilities you need to thrive in the ‘new normal’. That way you get exactly what you need to stay competitive – and we get the job satisfaction that keeps us motivated!

We manage your project the ‘Anaplan Way’

When it comes to implementation, Anaplan has a number of best practices that only experts like us can teach. As an accredited Anaplan partner, we have a deep knowledge of the underlying data architecture and rules engine, and know how to quickly build the solution you need using an ‘agile’ methodology that leads to a rapid implementation that fits your budget.

We provide a full-service offering

Our full-service offering covers both helping you envision and plan your implementation and the very technical know-how involved in implementing Anaplan, providing expertise in data architecture to ensure the Anaplan ecosystem exactly fits into your existing IT landscape. We will also assess the future implications of your implementation, giving you a sound foundation for future developments as you expand across the Anaplan honeycomb.

Look no further - Profit& is here to help

We will then begin to build your planning ecosystem, all the time looking for quick wins while steadily building capabilities that will result in a compelling ROI. At the same time, we will provide training for your employees, so Anaplan becomes a widely-used and easily accessible platform that you can manage within your finance team.

If you’re interested in starting your journey to better cost and profitability management or even just finding out more information, please contact us. We’ll be happy to answer any of your questions. Just click the button below to get in touch.